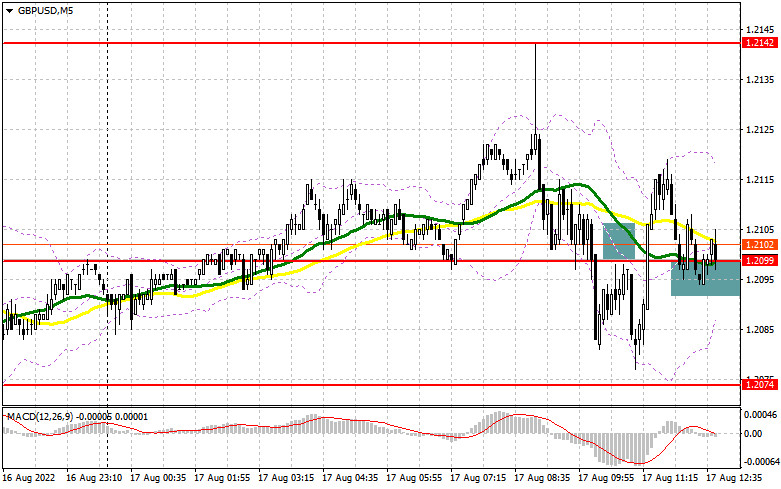

In my forecast this morning, I drew your attention to the level of 1.2099 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze what happened. The price broke through 1.2099 without a reverse bottom/top test, which was literally 1 pip short. Those who sold the pound during that correction could take about 25 pips of profit. At the time of writing, the pair returned to 1.2099, and the reverse top/bottom test gave a buy signal. In the second half of the day, the technical picture changed significantly.

Long positions on GBP/USD:

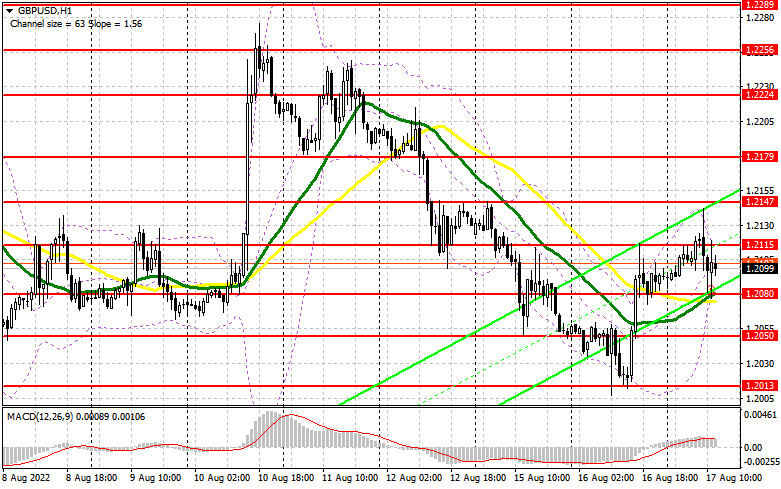

As long as the pair is trading above 1.2080, the demand for the pound will remain, which will allow us to count on a breakthrough of 1.2115. According to the Office for National Statistics report released today, the consumer price index in the UK rose to 10.1% in July on a yearly basis after growing to 9.4% a month earlier. The latest CPI was higher than economists had expected, estimating inflation rising to 9.8%. Rising food prices spurred the index, indicating that inflationary pressures are not just related to energy prices, which the UK government has been talking about a lot lately. In the afternoon, we are going to see the FOMC minutes and how aggressive the governors will be in raising the interest rates will determine the quotes. Bulls have already created the lower boundary of the uptrend channel near 1.2080 and if the pair descends, the market is likely to focus on that level. A false breakout at 1.2080 will give a buy signal, counting on a prolonged correction. In this case, the target will be located at the new resistance of 1.2115, which was formed in the first half of the day. If that level is pierced and we see a reverse top/bottom test of it, the pair may go to 1.2147 and to the next target at the high of 1.2179, where traders can lock in profits. If the GBP/USD pair declines and bulls show weak activity near 1.2080, where the MAs support bulls, it would be better to postpone buying the pound until the pair reaches support at 1.2050. This level is the bulls' last hope to continue the growth. Only a false breakout at 1.2050 may form a buy signal. It is possible to open long positions on a rebound from 1.2013 or lower near 1.1967, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears can count on the strong US retail sales index in July, which will bring back the pressure on the pair. They also need to hold the price above 1.2115 and a false breakout at this level, which will allow them to count on the pair returning to the area of 1.2080. Bears really need to close the day below this level, which gives a good prospect for the resumption of the bearish trend, which was observed since the middle of the last week. A breakthrough and a bottom/top test of 1.2080 may give a sell entry point with a fall to 1.2050, and the next target will be located in the area of 1.2013, where traders may lock in profits. If the GBP/USD pair grows and bears show a lack of activity at 1.2115, bulls will get a chance to continue the uptrend and reach new monthly highs. In that case, it would be better to postpone selling the pound as only a false breakout at 1.2147 will give an entry point to short positions, counting on a downside rebound of the pair. If we see no activity there as well, there might be an upside move to the highs at 1.2179, where you can open short positions counting on a rebound, allowing an intraday downward correction of 30-35 pips.

The COT report for August 9 logged a decrease in short positions and an increase in long positions, which led to a decrease in the negative delta. Although a smaller contraction in UK GDP in Q2 2022 would allow us to expect that the economy can survive the crisis more steadily. However, this fact does not make households pay less for utility bills, which only exacerbates the cost of living crisis in the country. Rumors that the UK economy will slip into recession by the end of the year also do not add confidence to traders and investors. The GBP/USD pair is also affected by the decisions of the Federal Reserve. Last week, it became known that inflation in the US slowed down a bit. It is a good reason to pay attention to risky assets, but it is unlikely to lead to a strengthening of the bullish trend of the pound. Most likely, the pair is likely to be trading within a wide sideways channel until the end of the month, as we can hardly expect the price to reach new monthly highs. The COT report showed that long non-commercial positions rose by 12,914 to 42,219, while short non-commercial positions fell by 9,027 to 76,687, bringing the negative non-commercial net position down to -34,468 from -56,409. The weekly closing price declined to 1.2038 against 1.2180.

Indicator signalsMoving averageThe pair is trading above the 30- and 50-day moving averages, indicating a chance for buyers to continue to drag the pound upNote: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart.Bollinger BandsIf the price grows, the upper boundary of the indicator at 1.2115 will act as resistance.Indicators description

- Moving average defines the current trend by smoothing out market volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing out market volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator Fast EMA of period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.