Analysts of positions and tips for trading GBP

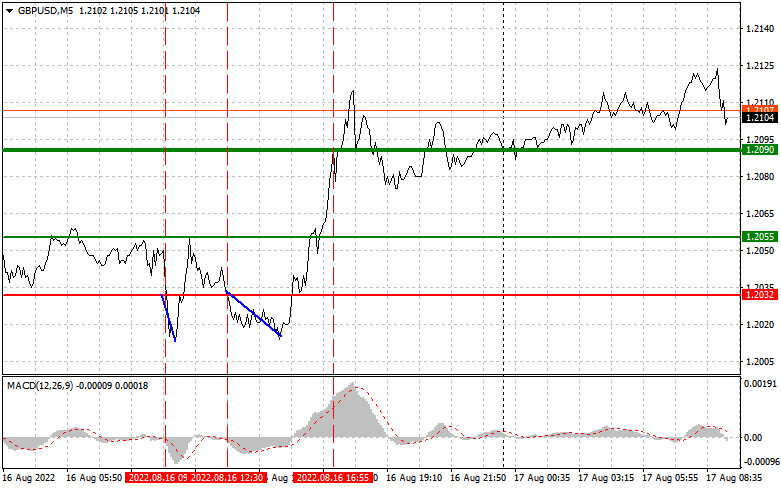

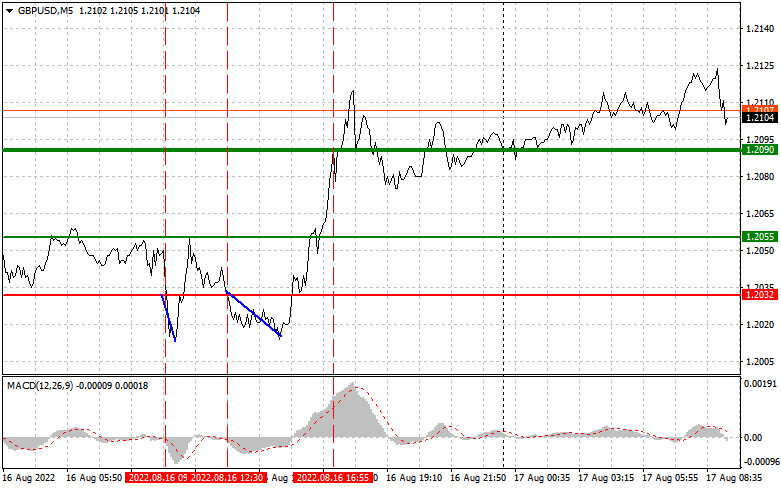

The first test of 1.2032 occurred at a time when the MACD had just started to move down from the zero level. It gave a good entry point for short positions. Unfortunately, a sell signal did not last long. After dropping by 15 pips, the pressure on the pound sterling decreased. Closer to the middle of the day, a similar sell signal appeared, which also led to a downward movement of about 15 pips. The pound/dollar pair rose sharply in the afternoon. The test of 1.2090, where I advised selling immediately for a rebound, gave a sell signal. However, the signal did not bring the expected result.

The pound sterling declined slightly in the first half of the day following labor market data. However, the pair avoided a new big sell-off thanks to a sharp increase in average weekly earnings. After the release of the US housing market report, the pound/dollar pair asserted strength, signaling a trend reversal. Today, in the morning, the UK Consumer Price Index and the UK Retail Price Index will be in the spotlight. If these indicators climb higher, which is likely, the pound sterling will face strong bearish pressure. It will limit the upward potential of the pair. In this case, I would advise you to act according to scenario No. 2 for opening short positions. In the afternoon, there will be more crucial economic reports, namely US retail sales data. If the reading drops, it is likely to undermine a rally of the US dollar in the short term. A negative figure will indicate an impending recession. The publication of the FOMC meeting minutes will shed light on the Fed's future plans for monetary policy in the autumn. If there are hints at less aggressive rate hikes, it could fuel demand for risky assets. Fed official Michelle Bowman will deliver a speech today, however, traders are likely to ignore it.

Buy signal

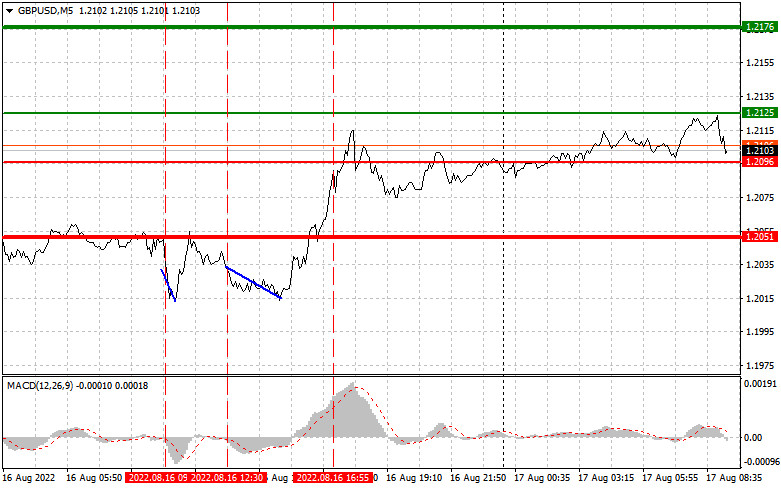

Scenario No.1: it is recommended to open long positions on the pound sterling today if the price reaches 1.2125 (green line on the chart) with the prospect of a rise to 1.2176 (thicker green line on the chart). At the 1.2176 level, I recommend closing all long positions and opening short ones, keeping in mind a correction of 30-35 pips from the given level. The par may advance significantly only if UK inflation data is positive. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to rise from it.

Scenario No.2: it is also possible to buy the pound sterling today if the price approaches 1.2096. At this moment, the MACD indicator should be in the oversold area, which will limit the downward potential. It may also trigger an upward reversal of the market. The pair is expected to lift up to the opposite levels of 1.2125 and 1.2176.

Sell signal

Scenario No.1: it is recommended to open short positions if the pair hits 1.2096 (the red line on the chart). It could lead to a rapid decline in the pair. The bears should focus on the 1.2051 level. At this level, it is better to close all short positions and open long ones, keeping in mind a correction of 20-25 pips from the given level. The pressure on the pound sterling may return if the UK CPI index rises. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price drops to 1.2125. At that moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal. The pair is projected to edge lower to the opposite levels of 1.2096 and 1.2051.

What is on the chart:

The thin green line is the entry point where you can buy the trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to rise above this level.

The thin red line is the entry point where you can sell the trading instrument.

The thick red line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. Before the release of important fundamental reports, it is better to stay out of the market. It will help you avoid losses due to sharp price fluctuations. If you decide to trade during the news release, always place Stop loss orders to minimize losses. Without placing Stop loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous decisions based on the current market situation is a losing strategy of an intraday trader.